India’s fintech sector is entering a decisive phase as regulatory oversight tightens and digital banking moves from rapid experimentation to structured maturity. The Reserve Bank of India’s latest compliance-focused interventions signal a clear message: innovation must be matched with accountability, transparency, and consumer protection. For fintech startups operating across payments, lending, neo-banking, and embedded finance, the digital banking reset is not a future concern—it is a present reality that demands immediate attention.

Why the Digital Banking Reset Is Happening Now

Over the past decade, fintech innovation has transformed how Indians borrow, save, invest, and transact. While this growth has improved financial inclusion and efficiency, it has also exposed regulatory gaps, data risks, and consumer protection challenges. Instances of opaque lending practices, data misuse, and operational failures have raised concerns among regulators.

The Reserve Bank of India has responded by reinforcing compliance norms to ensure that digital banking growth remains sustainable. The reset is aimed at strengthening trust in the financial system while preventing systemic risks that could arise from unchecked innovation.

What the New RBI Compliance Push Signals

The RBI’s recent regulatory actions indicate a shift from principle-based guidance to more explicit compliance expectations. Fintech startups are now expected to operate with the same seriousness and discipline as traditional financial institutions, especially when handling customer funds, data, and credit decisions.

This does not mean innovation is being discouraged. Instead, the regulator is making it clear that fintech-led growth must operate within clearly defined boundaries that protect consumers and ensure financial stability.

Greater Accountability in Digital Lending Models

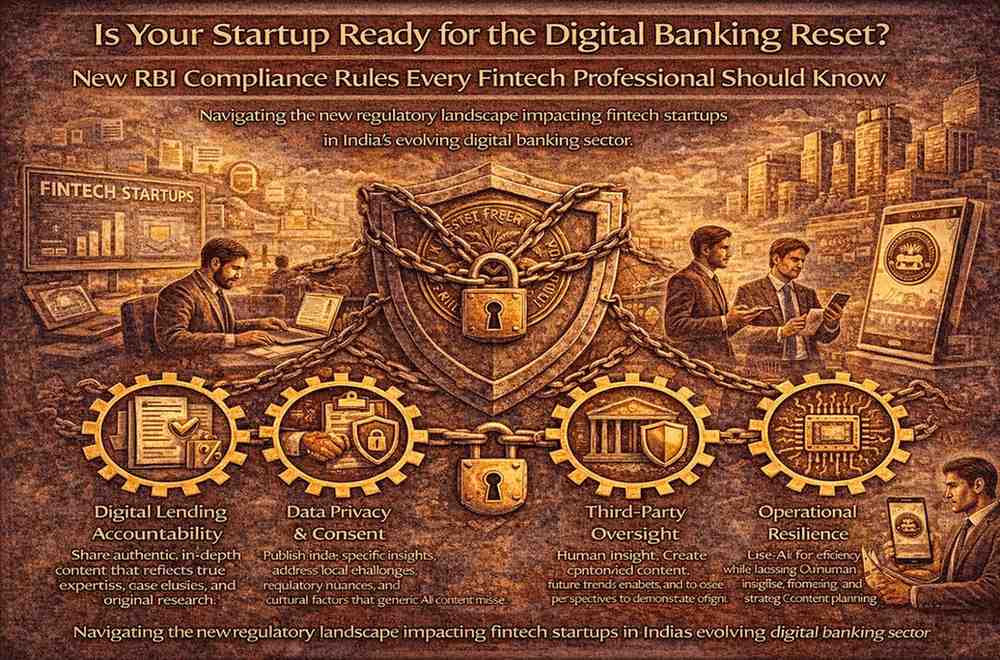

Digital lending has been a major focus area of regulatory scrutiny. The RBI has emphasised that only regulated entities can undertake core lending activities, while fintech platforms must clearly position themselves as service providers unless they hold appropriate licenses.

Startups involved in loan origination, underwriting support, or customer acquisition must ensure transparent disclosure of lender identity, interest rates, fees, and grievance mechanisms. The era of complex, multi-layered lending structures with blurred accountability is coming to an end.

Data Privacy and Consent Are Now Central Compliance Issues

Data has always been at the heart of fintech innovation, but regulatory expectations around data governance have tightened significantly. Startups must now demonstrate clear consent frameworks, purpose limitation, and secure data storage practices.

The RBI’s stance reinforces that customer data cannot be monetised or shared without explicit permission. Fintech professionals must treat data protection as a core operational function, not just a legal checkbox, particularly as digital banking becomes more deeply embedded in everyday financial life.

Stronger Oversight of Third-Party Partnerships

Many fintech startups rely on partnerships with banks, NBFCs, and technology vendors to deliver services. The digital banking reset places greater responsibility on regulated entities to oversee these partnerships, but fintechs are equally accountable for compliance.

This means startups must be prepared for stricter audits, deeper due diligence, and tighter contractual obligations. Weak compliance frameworks or unclear roles within partnerships can now pose serious business risks.

Operational Resilience and Technology Governance

Beyond compliance on paper, the RBI is increasingly focused on operational resilience. Digital banking systems must be robust, secure, and capable of handling scale without compromising service continuity or data integrity.

Fintech startups are expected to invest in stronger cybersecurity, disaster recovery planning, and technology governance. Outages, breaches, or repeated operational failures are no longer viewed as teething problems but as serious compliance concerns.

Impact on Neo-Banks and Embedded Finance Players

Neo-banks and embedded finance startups face particular scrutiny under the new regulatory environment. While these models rely on seamless user experiences and API-driven integration, they also sit at the intersection of multiple regulated activities.

The RBI’s compliance expectations require such startups to clearly define their role, avoid misrepresentation, and ensure that customers understand who is providing the underlying financial service. Transparency in branding, communication, and disclosures has become non-negotiable.

What Fintech Professionals Need to Relearn

For fintech professionals, the digital banking reset calls for a mindset shift. Growth, product design, and go-to-market strategies must now be built with compliance as a foundational element. Regulatory literacy is no longer limited to legal teams; product managers, engineers, and business leaders must understand how rules shape operations.

This also creates demand for new skill sets within fintech companies, including compliance technology, risk management, and regulatory operations. Startups that invest early in these capabilities will adapt more smoothly to the evolving environment.

Short-Term Challenges, Long-Term Stability

In the short term, stricter compliance may slow down experimentation and increase operational costs. Some business models may need restructuring, and partnerships may be reassessed. However, the long-term impact is likely to be positive.

Clear rules reduce uncertainty, improve consumer trust, and attract more patient capital. A compliant fintech ecosystem is better positioned to scale responsibly and integrate more deeply with India’s formal financial system.

How Startups Can Prepare for the Reset

Preparation begins with internal audits and honest assessment of regulatory exposure. Startups should review data practices, partner agreements, customer communication, and technology infrastructure through a compliance lens.

Engaging proactively with regulators, industry bodies, and legal experts can help anticipate changes rather than react to enforcement actions. Building compliance into product design, rather than retrofitting it later, will be a key competitive advantage.

The Bigger Picture for India’s Fintech Ecosystem

The digital banking reset reflects the natural evolution of a maturing sector. India’s fintech story is moving from rapid disruption to institutional credibility. Regulation is not an obstacle to growth but a framework for sustainable innovation.

Is your startup ready for the digital banking reset? The answer depends on how seriously compliance is treated today. For fintech professionals, understanding and embracing the new RBI rules is not just about avoiding penalties—it is about building resilient, trusted, and future-ready financial businesses in India’s next phase of digital banking growth.

Add pioneertoday.in as preferred source on google – click here