Top 10 FinTech Startups in India

Top 10 Fintech Startups in India that are revolutionizing the financial landscape with innovative solutions. From Paytm’s comprehensive digital financial services and Razorpay’s streamlined business payments to PhonePe’s widespread UPI adoption and PolicyBazaar’s insurance comparison platform, explore how these fintech leaders are driving financial inclusion and accessibility. Learn about Zerodha’s democratization of trading, Groww’s user-friendly investment options, Cred’s unique reward system for credit card payments, Lendingkart’s fast business loans for SMEs, MobiKwik’s extensive digital wallet services, and Pine Labs’ robust merchant solutions. Get insights into their founding stories, key services, missions, and impact on India’s economy. Here’s an in-depth look at the Top 10 Fintech Startups in India that are redefining financial services in the country.

1. Paytm

Founded in 2010 by Vijay Shekhar Sharma, Paytm has transitioned from a mobile recharge platform to a comprehensive digital financial services company. Paytm’s key services include a mobile wallet, UPI payments, e-commerce, and financial services such as insurance, mutual funds, and banking through Paytm Payments Bank. As one of India’s pioneering mobile payment platforms, Paytm boasts over 350 million registered users and 20 million merchants, making it a significant player in the digital payments ecosystem.

| Category | Details |

|---|---|

| Founded | 2010 |

| Founders | Vijay Shekhar Sharma |

| Headquarters | Noida, Uttar Pradesh |

| Key Services | – Mobile wallet<br>- UPI payments<br>- E-commerce<br>- Financial services (insurance, mutual funds, banking through Paytm Payments Bank) |

| Website | paytm.com |

| Mission | To bring half a billion Indians into the mainstream economy through technology-driven financial inclusion. |

2. Razorpay

Established in 2014 by Harshil Mathur and Shashank Kumar, Razorpay offers full-stack financial solutions. Its primary services encompass payment gateway solutions, business banking with RazorpayX, and lending through Razorpay Capital. Razorpay serves over 8 million businesses, simplifying complex payment flows and providing robust financial solutions tailored for businesses of all sizes.

| Category | Details |

|---|---|

| Founded | 2014 |

| Founders | Harshil Mathur, Shashank Kumar |

| Headquarters | Bangalore, Karnataka |

| Key Services | – Payment gateway solutions<br>- Business banking with RazorpayX<br>- Lending through Razorpay Capital |

| Website | razorpay.com |

| Mission | To simplify and democratize financial services for businesses of all sizes. |

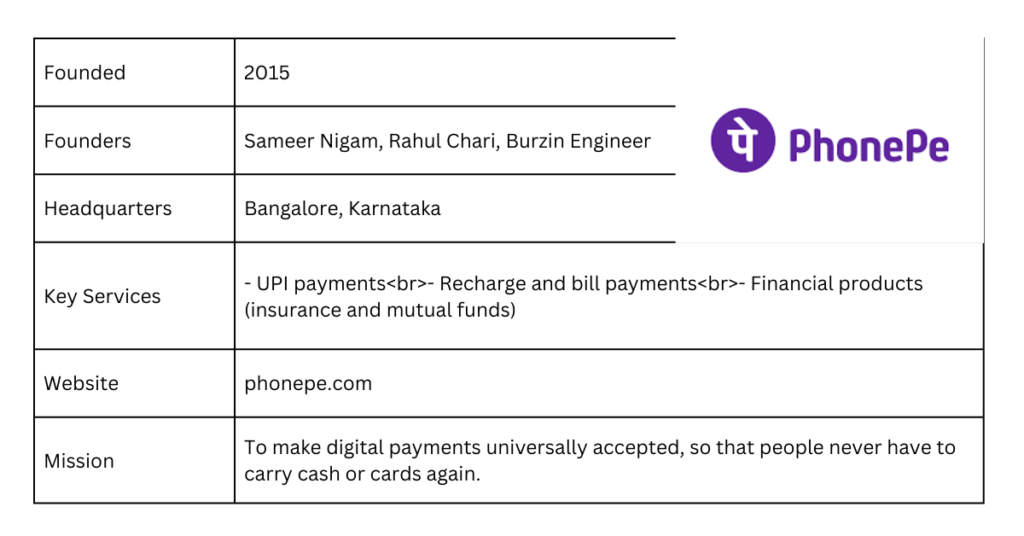

3. PhonePe

Launched in 2015 by Sameer Nigam, Rahul Chari, and Burzin Engineer, PhonePe has become a leading digital payments platform in India. PhonePe’s core services include UPI payments, recharge and bill payments, and financial products such as insurance and mutual funds. With over 300 million users and more than 200 million monthly transactions, PhonePe is a dominant force in the digital payment landscape.

| Category | Details |

|---|---|

| Founded | 2015 |

| Founders | Sameer Nigam, Rahul Chari, Burzin Engineer |

| Headquarters | Bangalore, Karnataka |

| Key Services | – UPI payments<br>- Recharge and bill payments<br>- Financial products (insurance and mutual funds) |

| Website | phonepe.com |

| Mission | To make digital payments universally accepted, so that people never have to carry cash or cards again. |

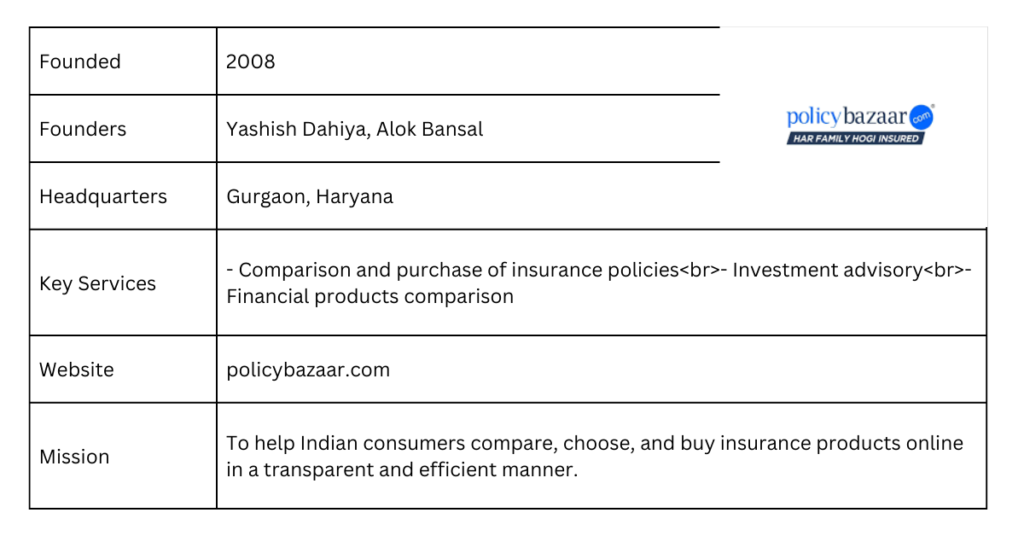

4. PolicyBazaar

Founded in 2008 by Yashish Dahiya and Alok Bansal, PolicyBazaar is a prominent online insurance aggregator. It provides a platform for comparing and purchasing insurance policies, investment advisory services, and comparison of various financial products. PolicyBazaar plays a crucial role in India’s insurance market, facilitating over 25% of life cover and 7% of retail health insurance sales.

| Category | Details |

|---|---|

| Founded | 2008 |

| Founders | Yashish Dahiya, Alok Bansal |

| Headquarters | Gurgaon, Haryana |

| Key Services | – Comparison and purchase of insurance policies<br>- Investment advisory<br>- Financial products comparison |

| Website | policybazaar.com |

| Mission | To help Indian consumers compare, choose, and buy insurance products online in a transparent and efficient manner. |

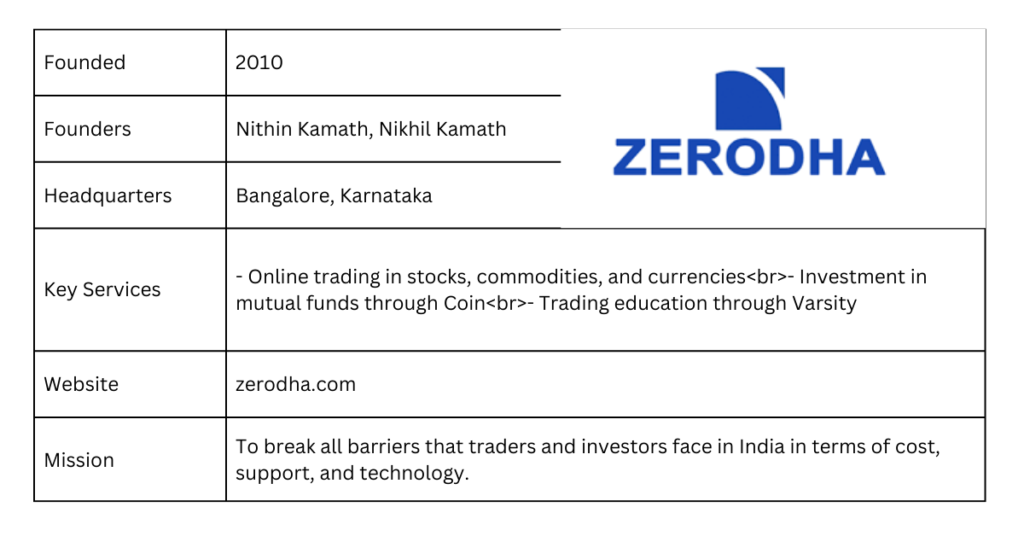

5. Zerodha

Founded in 2010 by Nithin Kamath and Nikhil Kamath, Zerodha is India’s largest stockbroker. Zerodha offers online trading in stocks, commodities, and currencies, investment in mutual funds through Coin, and trading education via Varsity. With over 4 million active clients and handling more than 15% of all retail order volumes in India, Zerodha has democratized access to trading and investment.

| Category | Details |

|---|---|

| Founded | 2010 |

| Founders | Nithin Kamath, Nikhil Kamath |

| Headquarters | Bangalore, Karnataka |

| Key Services | – Online trading in stocks, commodities, and currencies<br>- Investment in mutual funds through Coin<br>- Trading education through Varsity |

| Website | zerodha.com |

| Mission | To break all barriers that traders and investors face in India in terms of cost, support, and technology. |

6. Groww

Established in 2016 by Lalit Keshre, Harsh Jain, Neeraj Singh, and Ishan Bansal, Groww is an investment platform designed for simplicity and accessibility. Groww offers services such as direct mutual fund investments, stock trading, and digital gold investment. The platform is popular among beginners, boasting over 20 million users and a user-friendly interface that simplifies the investment process.

| Category | Details |

|---|---|

| Founded | 2016 |

| Founders | Lalit Keshre, Harsh Jain, Neeraj Singh, Ishan Bansal |

| Headquarters | Bangalore, Karnataka |

| Key Services | – Direct mutual fund investments<br>- Stock trading<br>- Digital gold investment |

| Website | groww.in |

| Mission | To make investing simple and accessible to everyone. |

7. Cred

Founded in 2018 by Kunal Shah, Cred is a unique platform that rewards users for timely credit card bill payments. Cred’s key services include credit card bill payments, access to exclusive rewards and offers, and credit score tracking. With over 7.5 million users, Cred stands out for its reward-based model and its emphasis on promoting financial responsibility among users.

| Category | Details |

|---|---|

| Founded | 2018 |

| Founders | Kunal Shah |

| Headquarters | Bangalore, Karnataka |

| Key Services | – Credit card bill payments<br>- Access to exclusive rewards and offers<br>- Credit score tracking |

| Website | cred.club |

| Mission | To celebrate and reward the trustworthy, and responsible financial behavior. |

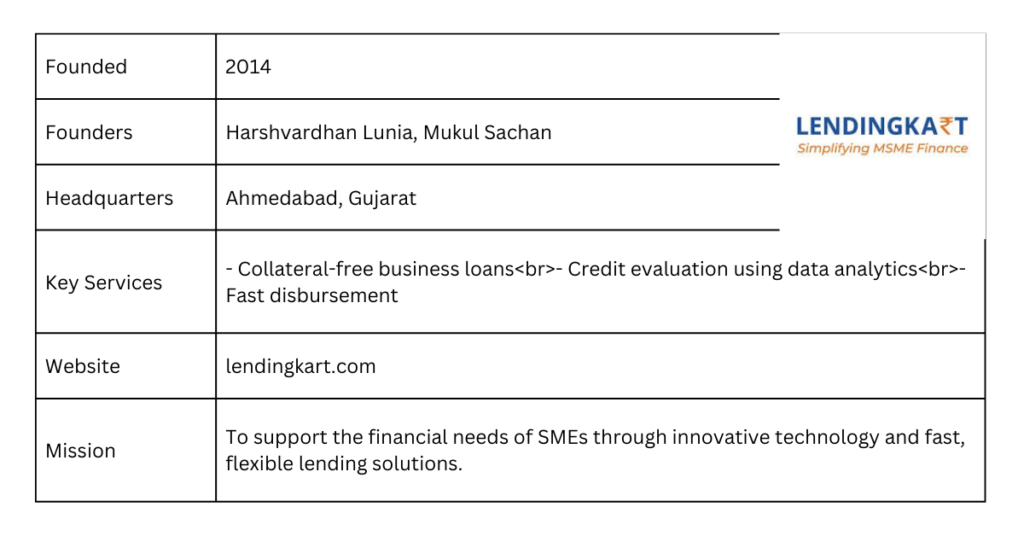

8. Lendingkart

Founded in 2014 by Harshvardhan Lunia and Mukul Sachan, Lendingkart provides quick and hassle-free working capital loans to SMEs. Lendingkart’s services include collateral-free business loans, credit evaluation using data analytics, and fast disbursement. Lendingkart has disbursed over 100,000 loans and served more than 1300 cities in India, significantly contributing to the financial empowerment of small businesses.

| Category | Details |

|---|---|

| Founded | 2014 |

| Founders | Harshvardhan Lunia, Mukul Sachan |

| Headquarters | Ahmedabad, Gujarat |

| Key Services | – Collateral-free business loans<br>- Credit evaluation using data analytics<br>- Fast disbursement |

| Website | lendingkart.com |

| Mission | To support the financial needs of SMEs through innovative technology and fast, flexible lending solutions. |

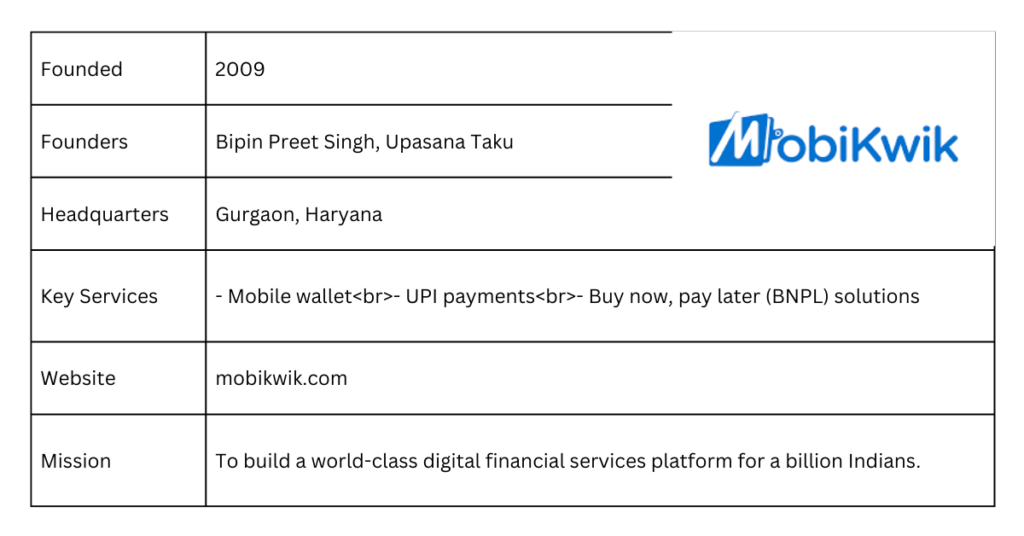

9. MobiKwik

Established in 2009 by Bipin Preet Singh and Upasana Taku, MobiKwik is a digital wallet and payment solutions provider. MobiKwik’s core offerings include a mobile wallet, UPI payments, and buy now, pay later (BNPL) solutions. With over 120 million users and 3 million merchants, MobiKwik is focused on financial inclusion and providing accessible financial services to a broad audience.

| Category | Details |

|---|---|

| Founded | 2009 |

| Founders | Bipin Preet Singh, Upasana Taku |

| Headquarters | Gurgaon, Haryana |

| Key Services | – Mobile wallet<br>- UPI payments<br>- Buy now, pay later (BNPL) solutions |

| Website | mobikwik.com |

| Mission | To build a world-class digital financial services platform for a billion Indians. |

10. Pine Labs

Founded in 1998 by Rajul Garg, Pine Labs has evolved into a leading merchant platform company, offering financing and last-mile retail transaction technology. Pine Labs provides POS (Point of Sale) solutions, consumer and merchant lending, and gift cards and loyalty programs. The company processes payments worth billions annually and supports over 150,000 merchants across Asia, solidifying its position in the fintech landscape.

| Category | Details |

|---|---|

| Founded | 1998 |

| Founders | Rajul Garg |

| Headquarters | Noida, Uttar Pradesh |

| Key Services | – POS (Point of Sale) solutions<br>- Consumer and merchant lending<br>- Gift cards and loyalty programs |

| Website | pinelabs.com |

| Mission | To leverage technology to solve complex problems in the payments and retail ecosystem. |

FAQs about Top 10 Fintech Startups in India

1. What is Paytm and what services does it offer?

Answer: Paytm, founded in 2010 by Vijay Shekhar Sharma, is a digital financial services company offering a mobile wallet, UPI payments, e-commerce, and various financial services such as insurance, mutual funds, and banking through Paytm Payments Bank. It is one of India’s largest mobile payment platforms with over 350 million registered users.

2. How does Razorpay help businesses?

Answer: Razorpay, founded in 2014 by Harshil Mathur and Shashank Kumar, offers full-stack financial solutions including payment gateway solutions, business banking with RazorpayX, and lending through Razorpay Capital. It simplifies payment processes for over 8 million businesses.

3. What makes PhonePe a popular payment platform?

Answer: PhonePe, launched in 2015 by Sameer Nigam, Rahul Chari, and Burzin Engineer, is popular for its easy-to-use UPI payments, recharge and bill payments, and financial products like insurance and mutual funds. It has over 300 million users and facilitates more than 200 million monthly transactions.

4. Why should I use PolicyBazaar for insurance?

Answer: PolicyBazaar, founded in 2008 by Yashish Dahiya and Alok Bansal, is an online insurance aggregator that allows users to compare and purchase insurance policies, get investment advice, and compare financial products. It helps consumers make informed decisions and covers over 25% of India’s life insurance sales.

5. How can Zerodha benefit traders and investors?

Answer: Zerodha, founded in 2010 by Nithin Kamath and Nikhil Kamath, is India’s largest stockbroker offering online trading in stocks, commodities, and currencies, mutual fund investments through Coin, and trading education via Varsity. It democratizes access to trading with over 4 million active clients.

6. What investment options does Groww provide?

Answer: Groww, founded in 2016 by Lalit Keshre, Harsh Jain, Neeraj Singh, and Ishan Bansal, is an investment platform offering direct mutual fund investments, stock trading, and digital gold investment. It has a user-friendly interface ideal for beginners and boasts over 20 million users.

7. How does Cred reward timely credit card payments?

Answer: Cred, founded in 2018 by Kunal Shah, is a platform that rewards users for timely credit card bill payments with exclusive offers and rewards. It also provides credit score tracking and has over 7.5 million users.

8. What kind of loans does Lendingkart offer?

Answer: Lendingkart, founded in 2014 by Harshvardhan Lunia and Mukul Sachan, provides collateral-free business loans to SMEs, using data analytics for credit evaluation and ensuring fast disbursement. It has disbursed over 100,000 loans across 1300 cities in India.

9. What services are available on MobiKwik?

Answer: MobiKwik, founded in 2009 by Bipin Preet Singh and Upasana Taku, is a digital wallet and payment solutions provider offering mobile wallet services, UPI payments, and buy now, pay later (BNPL) solutions. It serves over 120 million users and 3 million merchants.

10. How does Pine Labs support merchants?

Answer: Pine Labs, founded in 1998 by Rajul Garg, offers POS (Point of Sale) solutions, consumer and merchant lending, and gift cards and loyalty programs. It processes billions in payments annually and supports over 150,000 merchants across Asia.

Also read:

- Top 10 HealthTech Startups in India

- Top 10 FinTech Startups in India

- Top 10 AgriTech Startups in India

- Top 10 CleanTech Startups in India

- Top 10 InsurTech Startups in India

- Top 10 LegalTech Startups in India

- Top 10 GovTech Startups in India

- Top 10 RetailTech Startups in India

- Top 10 PropTech Startups in India

- Top 10 FoodTech Startups in India

- Top 10 EduTech Startups in India

Last Updated on: Friday, June 28, 2024 10:58 am by Pioneer Today Team | Published by: Pioneer Today Team on Tuesday, June 11, 2024 4:41 am | News Categories: Trending