Top 10 InsurTech Startups in India

Top 10 InsurTech Startups in India revolutionizing the insurance landscape with innovative digital solutions. From PolicyBazaar’s comprehensive comparison tools to Acko’s low-cost premiums and seamless claims processing, these startups are leveraging technology to enhance customer experience, streamline policy management, and provide affordable insurance options. Explore how companies like Digit Insurance, Coverfox, and Turtlemint are transforming insurance buying, renewal, and claims processes with their digital-first approaches. Learn about the unique offerings of startups like Toffee Insurance, Plum, Onsurity, and BimaPe, which are making insurance accessible and understandable for businesses and individuals alike. Stay informed about the cutting-edge technologies and customer-centric services driving the growth of the InsurTech sector in India. Here, we highlight ten standout InsurTech startups that are transforming the Indian insurance landscape.

1. PolicyBazaar

PolicyBazaar, founded in 2008 and headquartered in Gurugram, is India’s leading online insurance aggregator. It provides a platform for comparing and buying insurance policies across various categories including health, life, and motor insurance.

| ASPECT | DETAILS |

|---|---|

| Founded | 2008 |

| Headquarters | Gurugram |

| Services | Insurance comparison, policy purchase |

| Key Feature | Comprehensive comparison tool |

| Website | PolicyBazaar |

2. Coverfox

Established in 2013 and based in Mumbai, Coverfox offers a user-friendly platform for buying and managing insurance policies. It provides instant policy issuance and a hassle-free claims process, making it a popular choice for online insurance shoppers.

| ASPECT | DETAILS |

|---|---|

| Founded | 2013 |

| Headquarters | Mumbai |

| Services | Policy management, instant issuance |

| Key Feature | Simplified claims process |

| Website | Coverfox |

3. Digit Insurance

Digit Insurance, founded in 2016 in Bengaluru, focuses on simplifying insurance products and claims processes. Its digital-first approach and user-centric policies have garnered significant market share in health, motor, and travel insurance sectors.

| ASPECT | DETAILS |

|---|---|

| Founded | 2016 |

| Headquarters | Bengaluru |

| Services | Health, motor, travel insurance |

| Key Feature | Digital-first approach |

| Website | Digit Insurance |

4. Acko

Acko, established in 2016 in Mumbai, offers innovative insurance products with a focus on low-cost premiums and seamless claims processing. Acko leverages big data and digital tools to provide personalized insurance solutions.

| ASPECT | DETAILS |

|---|---|

| Founded | 2016 |

| Headquarters | Mumbai |

| Services | Motor, health, gadget insurance |

| Key Feature | Low-cost premiums, big data analytics |

| Website | Acko |

5. Toffee Insurance

Founded in 2017 and headquartered in Gurugram, Toffee Insurance offers bite-sized insurance products that are affordable and easy to understand. It targets specific lifestyle needs such as cycle, gadget, and travel insurance.

| ASPECT | DETAILS |

|---|---|

| Founded | 2017 |

| Headquarters | Gurugram |

| Services | Lifestyle insurance products |

| Key Feature | Affordable, targeted insurance |

| Website | Toffee Insurance |

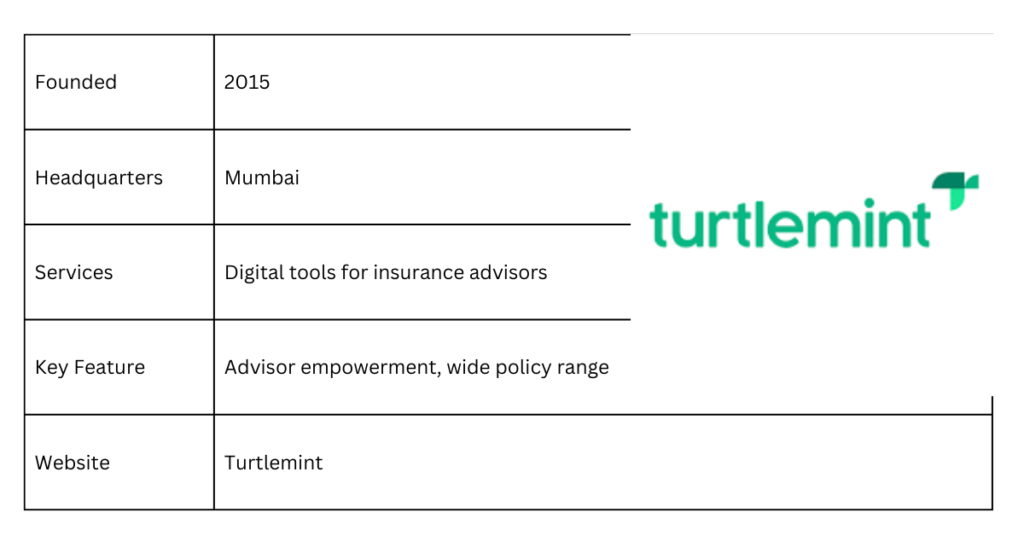

6. Turtlemint

Launched in 2015 in Mumbai, Turtlemint empowers insurance advisors with digital tools to sell and manage policies. It offers extensive training and support to advisors, ensuring a wide reach and better customer service.

| ASPECT | DETAILS |

|---|---|

| Founded | 2015 |

| Headquarters | Mumbai |

| Services | Digital tools for insurance advisors |

| Key Feature | Advisor empowerment, wide policy range |

| Website | Turtlemint |

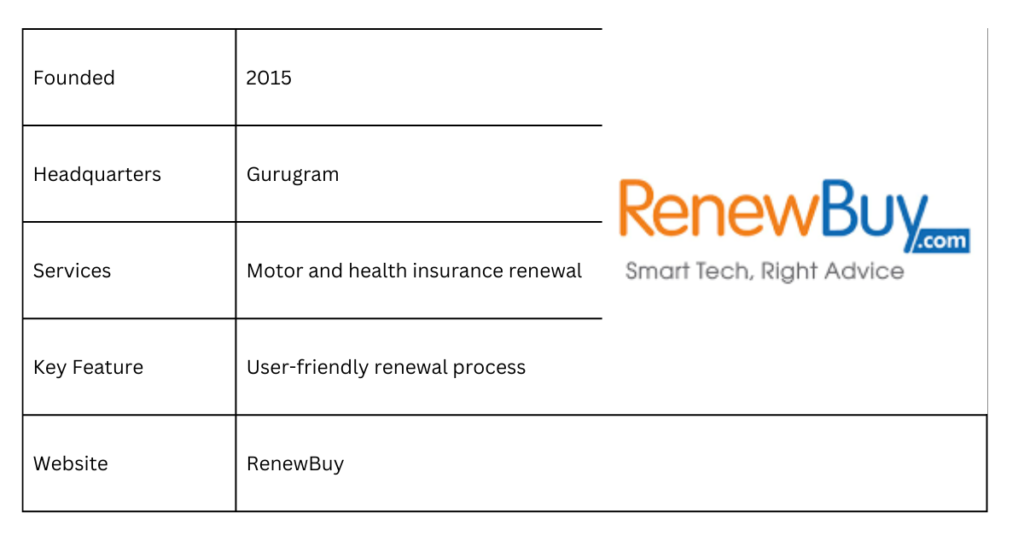

7. RenewBuy

Established in 2015 in Gurugram, RenewBuy specializes in offering a seamless online platform for renewing motor and health insurance policies. Its user-friendly interface and extensive network of partners simplify the renewal process.

| ASPECT | DETAILS |

|---|---|

| Founded | 2015 |

| Headquarters | Gurugram |

| Services | Motor and health insurance renewal |

| Key Feature | User-friendly renewal process |

| Website | RenewBuy |

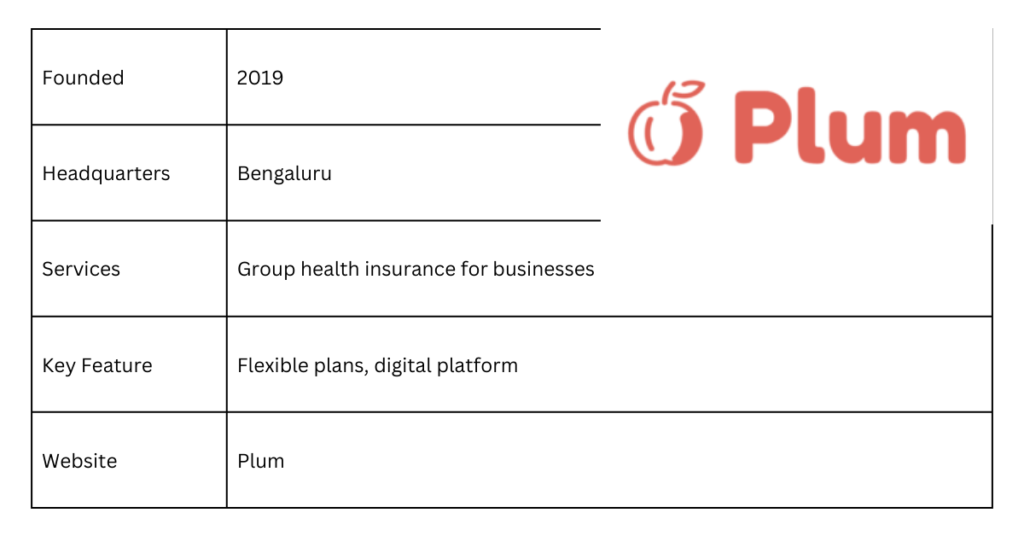

8. Plum

Plum, founded in 2019 in Bengaluru, is revolutionizing group health insurance for businesses. It offers flexible and affordable health insurance plans tailored for startups and SMEs, along with an intuitive digital platform for policy management.

| ASPECT | DETAILS |

|---|---|

| Founded | 2019 |

| Headquarters | Bengaluru |

| Services | Group health insurance for businesses |

| Key Feature | Flexible plans, digital platform |

| Website | Plum |

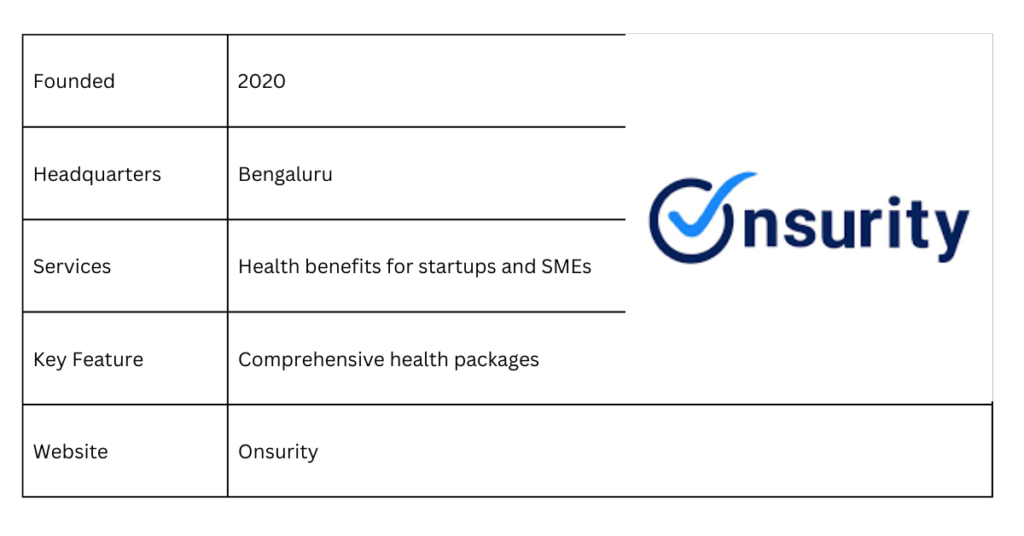

9. Onsurity

Launched in 2020 in Bengaluru, Onsurity provides affordable and comprehensive health benefits for startups and small businesses. Its offerings include health insurance, wellness programs, and preventive healthcare services.

| ASPECT | DETAILS |

|---|---|

| Founded | 2020 |

| Headquarters | Bengaluru |

| Services | Health benefits for startups and SMEs |

| Key Feature | Comprehensive health packages |

| Website | Onsurity |

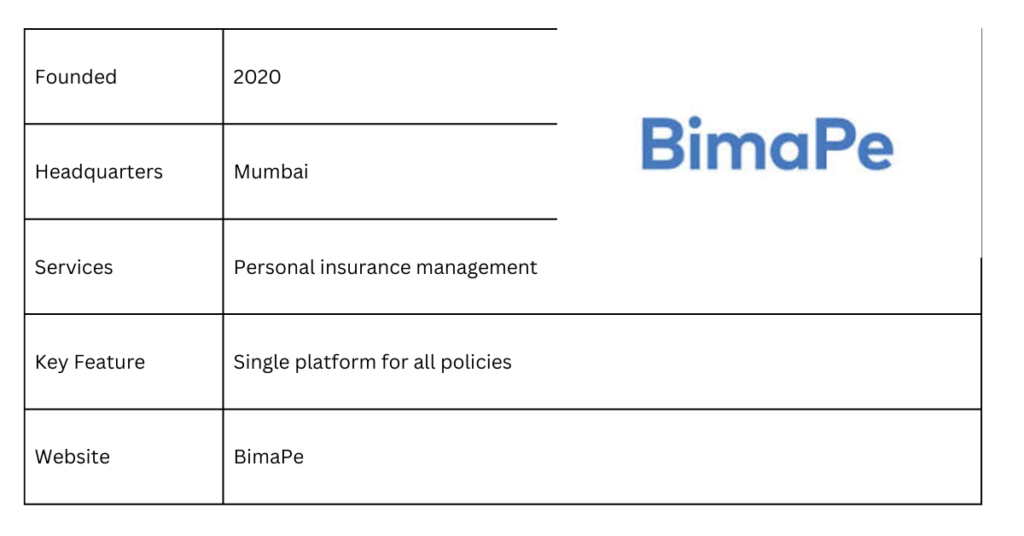

10. BimaPe

Founded in 2020 and based in Mumbai, BimaPe aims to simplify personal insurance management through its app. It offers a single platform to manage all insurance policies, providing insights and recommendations to optimize coverage.

| ASPECT | DETAILS |

|---|---|

| Founded | 2020 |

| Headquarters | Mumbai |

| Services | Personal insurance management |

| Key Feature | Single platform for all policies |

| Website | BimaPe |

FAQs about Top 10 InsurTech Startups in India

Q: What is an InsurTech startup?

A: An InsurTech startup leverages technology to improve and simplify the insurance process. This includes developing digital platforms for policy comparison, purchase, and management, as well as utilizing data analytics and AI to create personalized insurance solutions.

Q: How do InsurTech startups benefit customers?

A: InsurTech startups benefit customers by offering convenient, transparent, and cost-effective insurance solutions. They simplify policy comparison, streamline the purchase process, provide instant policy issuance, and enhance the claims process, making insurance more accessible and user-friendly.

Q: Are InsurTech startups regulated in India?

A: Yes, InsurTech startups in India are regulated by the Insurance Regulatory and Development Authority of India (IRDAI). These regulations ensure that the services offered are safe, reliable, and adhere to industry standards.

Q: Can I trust the services offered by InsurTech startups?

A: InsurTech startups often partner with established insurance companies and comply with regulatory requirements. They also use advanced technology to enhance transparency and reliability. Checking user reviews, ratings, and regulatory compliance can help gauge the trustworthiness of their services.

Q: How do InsurTech startups handle claims?

A: Many InsurTech startups offer a digital claims process that is fast and efficient. They use technology to automate and streamline the claims submission, verification, and settlement processes, ensuring a hassle-free experience for customers.

Conclusion

India’s InsurTech startups are playing a crucial role in transforming the insurance sector. By leveraging technology, these startups are making insurance more accessible, affordable, and customer-centric. As they continue to innovate and grow

Also read:

- Top 10 HealthTech Startups in India

- Top 10 FinTech Startups in India

- Top 10 AgriTech Startups in India

- Top 10 CleanTech Startups in India

- Top 10 InsurTech Startups in India

- Top 10 LegalTech Startups in India

- Top 10 GovTech Startups in India

- Top 10 RetailTech Startups in India

- Top 10 PropTech Startups in India

- Top 10 FoodTech Startups in India

- Top 10 EduTech Startups in India

Last Updated on: Friday, June 28, 2024 10:58 am by Pioneer Today Team | Published by: Pioneer Today Team on Tuesday, June 11, 2024 10:57 am | News Categories: Trending